PriceSpy - Black Friday Report 2023

PriceSpy's 2023 Black Friday Report

PriceSpy's 2023 Black Friday ReportWelcome to the third edition of PriceSpy's Black Friday Report.

Introduction

Black Friday has emerged as a pinnacle event in the global retail calendar.

More recently, its influence and impact has been felt here, and last year, Worldline reported that Black Friday spending reached $67 million in New Zealand.

- In the U.S., Adobe Analytics noted a modest 2.3 per cent increase in online Black Friday sales last year, totalling $9.12 billion.

- In contrast, even though Black Friday spending has been on the rise in New Zealand, last year Worldline reported spending dropped 6.9 per cent compared to the previous year (Black Friday 2021).

Regardless of the economic pressures people are facing, Black Friday remains pivotal in the retail landscape, both for retailers and consumers:

- For retailers, participating in Black Friday can help boost sales, manage and clear stock inventory, attract new customers and extend the shopping season;

- For consumers, Black Friday offers significant price reductions to make high-value items more accessible to purchase. Shoppers can also take advantage of reduced prices ahead of the expensive Christmas gift-buying season.

But what about the cost-of-living crisis?

As New Zealand grapples with the ongoing cost-of-living crisis, questions loom about how it will impact this year's Black Friday season:

- Will this Black Friday see an increase in consumer spending due to the allure of potential savings at an otherwise more expensive time?

- Are shoppers expecting larger discounts this year, and what are their projected spending levels?

- Might some opt out of Black Friday shopping altogether?

- Given the rising costs consumers face, could this be the most expensive Black Friday to date?

Utilising PriceSpy's comprehensive pricing data, historical trends, and insights from its newly commissioned independent survey*, this Black Friday Report seeks to answer key questions, offering deeper insight into the changing retail landscape.

November - the retail spending showdown month

November hosts a series of key sales events, including Singles' Day, Black Friday, and Cyber Monday, that set the stage for the Christmas shopping season.

These events create a competitive marketplace for retailers and offer consumers a wide range of choices at more affordable prices.

The Opening Act - Singles' Day - 11:11

Falling on 11 November (11:11), Singles’ Day serves as a notable precursor to the Black Friday bonanza. Originating in China, it is marked as an unofficial holiday to celebrate 'single-ness.' The event has transformed into a global retail juggernaut.

A quick Black Friday overview

Taking place this year on Friday, 24 November, Black Friday originates in the U.S.. The event follows Thanksgiving and marks the start of the holiday shopping season.

Once known for overnight queues and occasional stampedes of people, Black Friday has evolved with the rise of online shopping.

Black Friday's global reach

Once a U.S.-only event, Black Friday has extended its reach to markets globally, including New Zealand, the UK, and other countries in Europe and Latin America.

The Evolution: Black Friday to Black Month

As noted in PriceSpy's 2022 Black Friday Report, Black Friday has expanded into a longer sales period, often referred to as "Black Week" or "Black Month". As such, consumers can expect to see discounts being marked down from early November onwards, to encourage them to spend.

Singles’ Day - The world’s biggest sale day, but have Kiwis heard of it?

Singles’ Day is bigger than Black Friday

Occurring on 11th November, Singles' Day began as a Chinese celebration of singlehood (11:11) and has evolved into a global retail phenomenon, dwarfing both Black Friday and Cyber Monday. It reportedly generated $84.5 billion in gross merchandise volume in 2021.

Awareness for Singles’ Day is rising in New Zealand!

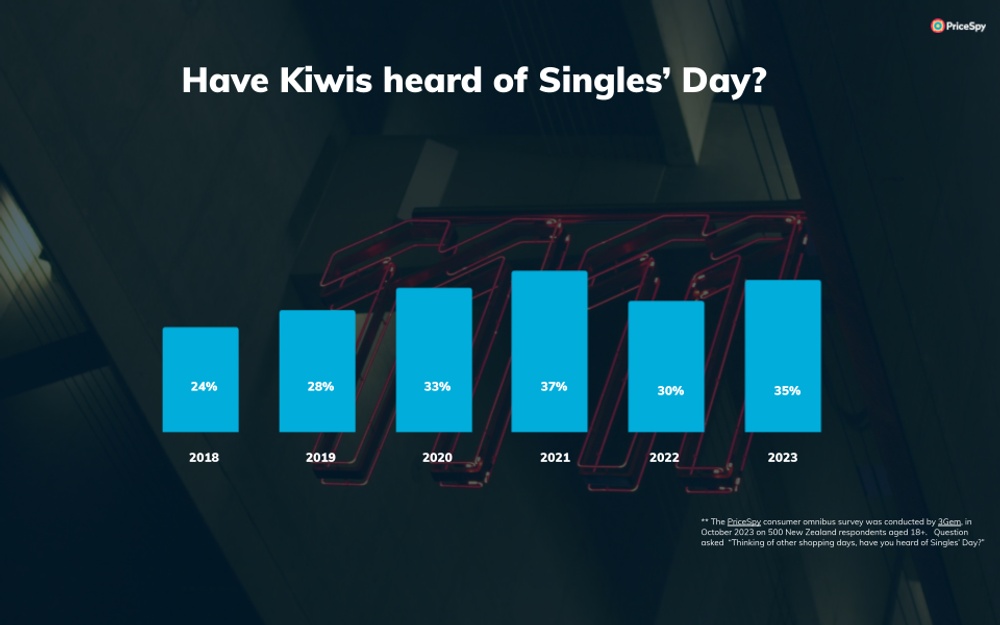

Although Singles' Day has not yet reached the same awareness levels of Black Friday and Boxing Day in New Zealand, according to PriceSpy's 2023 survey results*, awareness is growing:

- Over a third (36 per cent) of 2023 survey respondents say they have heard of Singles’ Day, marking a 13 per cent increase compared to 2018.

Kiwi retailers recognise the potential of Singles’ Day

Based on PriceSpy's Price Index**, a tool that monitors daily indexed price changes across the most-popular products on the comparison site, New Zealand retailers are recognising the immense spending potential that Singles' Day offers.

- Compared to a normal shopping day (1 November 2022), PriceSpy's Price Index** shows an indexed price drop of -1.58% on Singles' Day 2022. This suggests retailers are recognising their revenue potential and offering discounts.

Though the -1.58 per cent price drop may not seem significant, it actually is given the extensive range of thousands of products listed on PriceSpy, not to mention the frequent daily price fluctuations.

And, here are some prime examples of what kinds of discounts to expect from Singles’ Day:

- Over a quarter (26 per cent) of all products listed on PriceSpy saw a price drop on Singles’ Day 2022

- And of these items, seven per cent offered a discount equating to 10 per cent or more.

- Finally, the average price change on Singles’ Day last year was revealed to be -20 per cent.

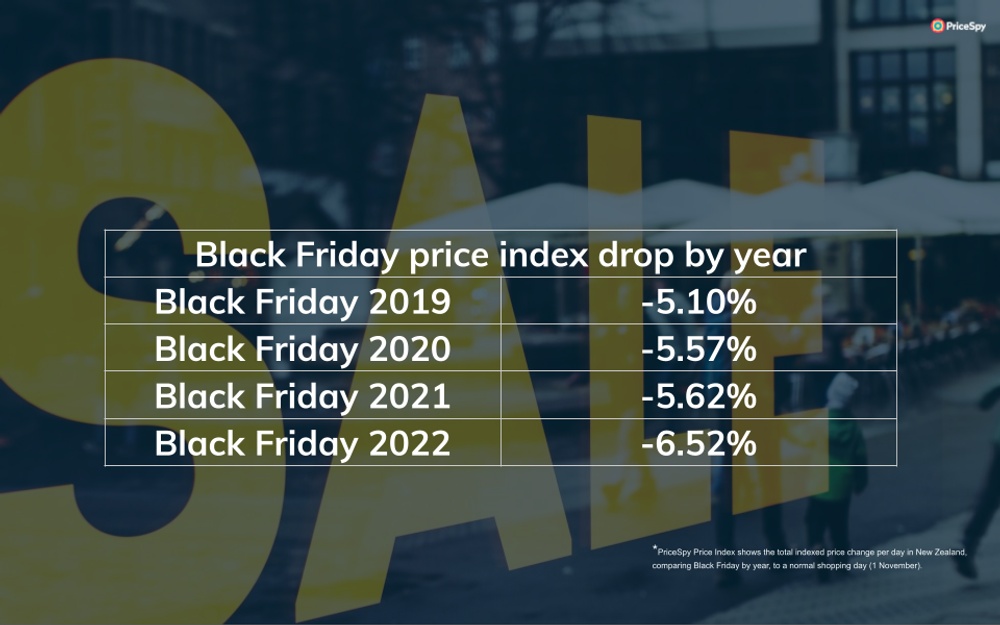

Singles’ Day vs. Black Friday

While awareness for Singles' Day is on the rise, the sales event still trails behind Black Friday when it comes to the scale of discounts offered.

- PriceSpy’s indexed** price drop on Black Friday last year fell by -6.52 per cent. Whereas on Singles’ Day, it was -1.58 per cent. This suggests that more products and significant discounts are offered on Black Friday.

Source: PriceSpy’s Price Index for November 2022.

Will Kiwis join the Singles’ Day Shopping Frenzy?

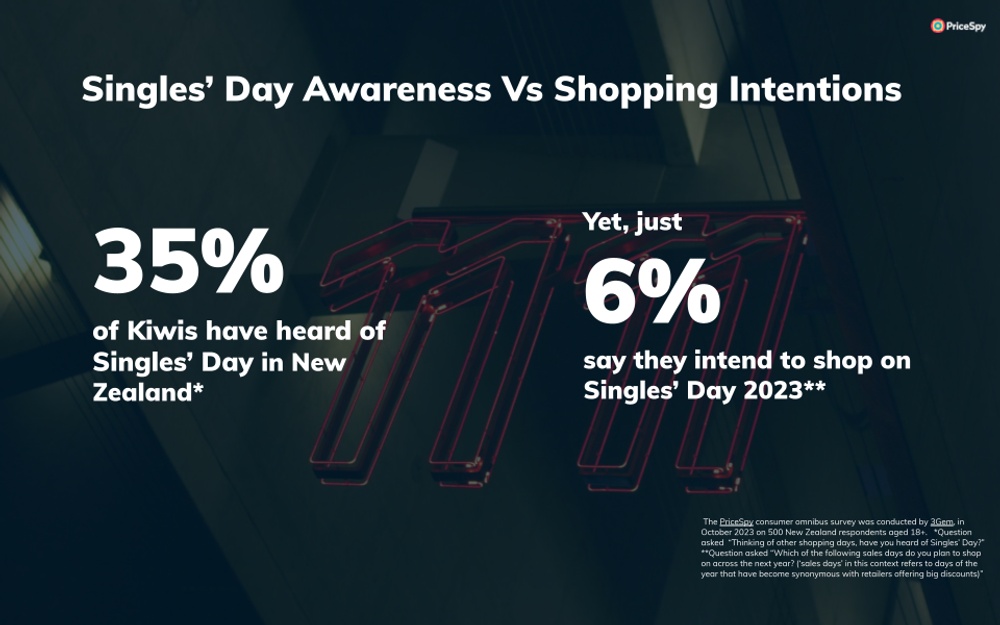

Though awareness is on the up, just six per cent of surveyed New Zealanders said they intend to shop on Singles' Day this year.

Singles’ Day - one to watch

Based on PriceSpy’s survey findings and pricing data, Singles’ Day is certainly an event to keep on the ‘watchlist’ over the next few years, as it could deliver some surprising discounts as more retailers get behind it.

The event also presents an alternative for those wanting to avoid the hustle and bustle and Black Friday queues.

Black Friday and the Cost of Living Crisis

Black Friday is becoming a retail heavyweight in New Zealand

Though Boxing Day has traditionally been the go-to sales event for Kiwis, Black Friday is rapidly gaining ground.

- According to PriceSpy data, consumer purchase interest on Black Friday last year peaked, underscoring its growing importance in New Zealand's retail calendar.

Source: PriceSpy - Consumer Purchase Interest data - 1 November 2022 - 6 December 2022

But, Kiwis are being hard hit by the cost of living crisis

Key findings from this year’s consumer omnibus survey lays bare the stark reality of New Zealand's cost of living crisis:

- A staggering nine out of ten (94 per cent) respondents say they feel impacted by the cost of living crisis.

- And, nearly half (48 per cent) of this group describe their situation as 'very impacted.'

Kiwis are feeling the pinch of price increases

The survey also indicates heightened consumer sensitivity towards price:

- 93 per cent of survey respondents this year say in light of the cost of living crisis they’ve observed price increases across consumer goods, food and fuel;

- And 77 per cent of this group say prices have 'significantly increased,' delivering a seven per cent year-on-year uptick.

So, have prices changed? And if so, by how much?

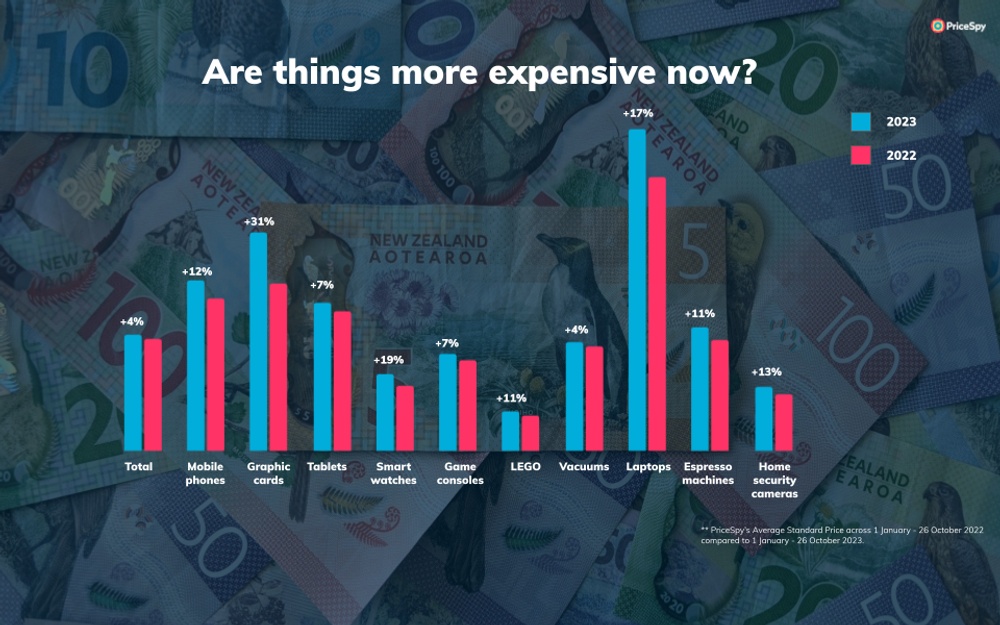

According to PriceSpy's historical data, price increases can be seen across several popular shopping categories. The degree of increase varies by category, offering valuable insight into potential price changes for this year's Black Friday:

****PriceSpy’s average standard price by category: 1 January - 26 October 2022 vs 1 January - 26 October 2023

PriceSpy’s research analysed average standard prices across 25 popular shopping categories:

- 80 per cent of the categories had more expensive standard average prices in 2023, compared to in 2022****;

- And, the standard price increase across 44 per cent of the categories rose more than the current rate of inflation, which recently fell from 6 per cent to 5.6 per cent in the 12 months to the September quarter;

- Even though consumers are clicking on cheaper products at the moment, PriceSpy’s research still found that average standard prices had increased across lots of categories.

But, there is some good news for consumers - the categories of air fryers and fryers, SSDs and fridge freezers were found to have dropped in price this year:

- Average standard prices of SSDs dropped 13 per cent in 2023 vs 2022****

- Average standard prices of airfryers and fryers dropped 5 per cent in 2023 vs 2022****

- Average standard prices fridge freezers dropped 1 per cent in 2023 vs 2022****

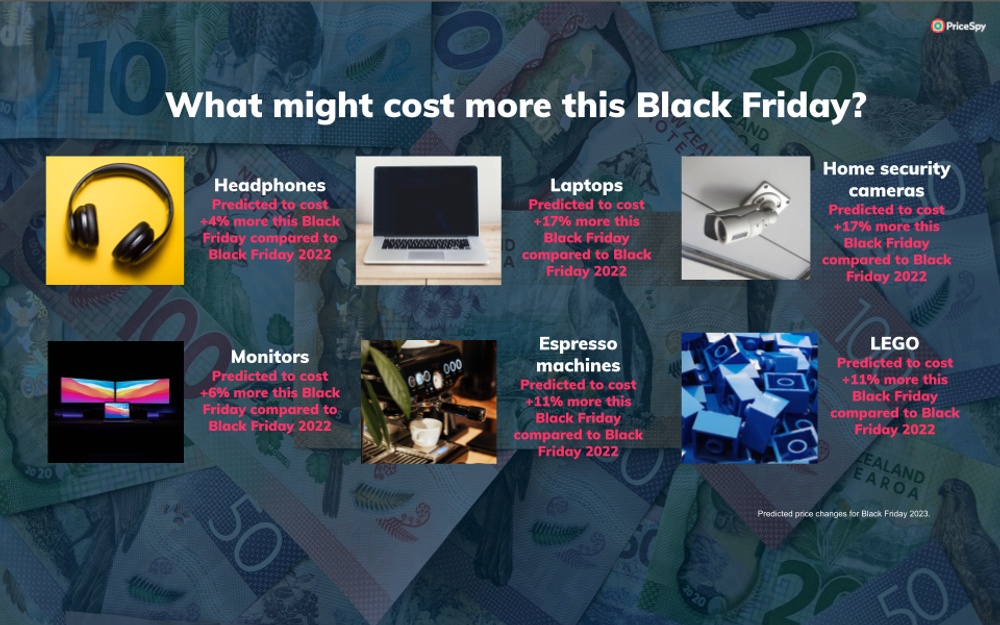

Will this Black Friday be the most expensive Black Friday yet?

Comparing last year's Black Friday discount to the average standard price across 2023****, it is likely that Black Friday prices this year will be higher across many shopping categories.

This could, in fact, be the most expensive Black Friday we’ve seen so far!

But, even if this year's Black Friday prices are higher than last year's, consumers should consider the general inflation of product prices over the year. As a result, Black Friday deals may still offer significant savings compared to current standard prices.

In essence, to assess the true value of a Black Friday deal, it's crucial to examine the product's historical pricing rather than focusing solely on the Black Friday discount rate.

Despite economic pressures, Kiwis intend to spend more this Black Friday!

Kiwis still intend to buy this Black Friday!

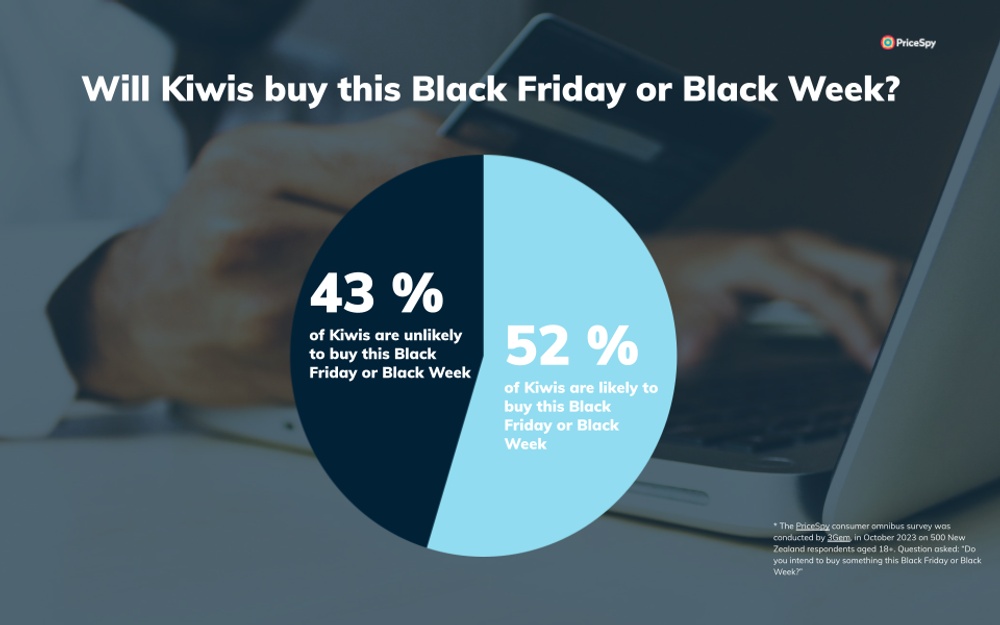

Despite today’s economic challenges impacting consumer sentiments, some 52 per cent of Kiwis intend to buy this Black Friday, according to PriceSpy's 2023 survey, delivering the same result as 2022.

This is likely to be driven by today's challenging economy and the ongoing cost of living crisis, as Kiwis are becoming more price-cautious and saving their purchases for Black Friday.

But shoppers are looking to spend BIG!

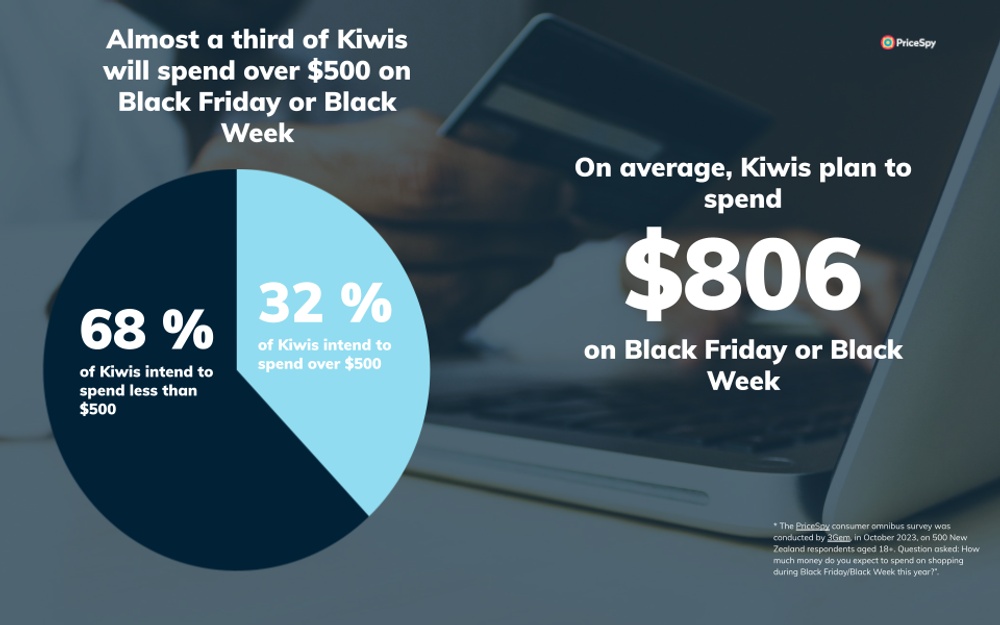

Despite rising living costs, surprisingly, Kiwi shoppers plan to spend significantly more on Black Friday this year:

- PriceSpy's latest survey results indicate that Kiwis plan to spend an additional $75 this Black Friday and Black Week, offering a 10 per cent year-on-year increase (average planned expenditure in 2023 is $806, compared to $731 in 2022).

And, almost a third (32 per cent) of Kiwis plan to spend over $500 on Black Friday or Black Week this year.

In summary, of those that are looking to shop, people are intending to spend more!

Consumers are primed to capitalise on Black Friday's discount landscape

Based on PriceSpy’s survey insights, consumers appear to be using Black Friday strategically, to help make substantial savings:

- For example, amid rising costs, people may be postponing major purchases, such as appliances and electronics, to leverage the discounts offered on Black Friday.

- Some may also be using the event to bulk-buy Christmas gifts, effectively distributing their expenses while maximising value.

Others are approaching Black Friday more cautiously!

Whilst many are looking to shop across Black Friday and Black Week this year, others are showing hesitation. PriceSpy's latest survey highlights:

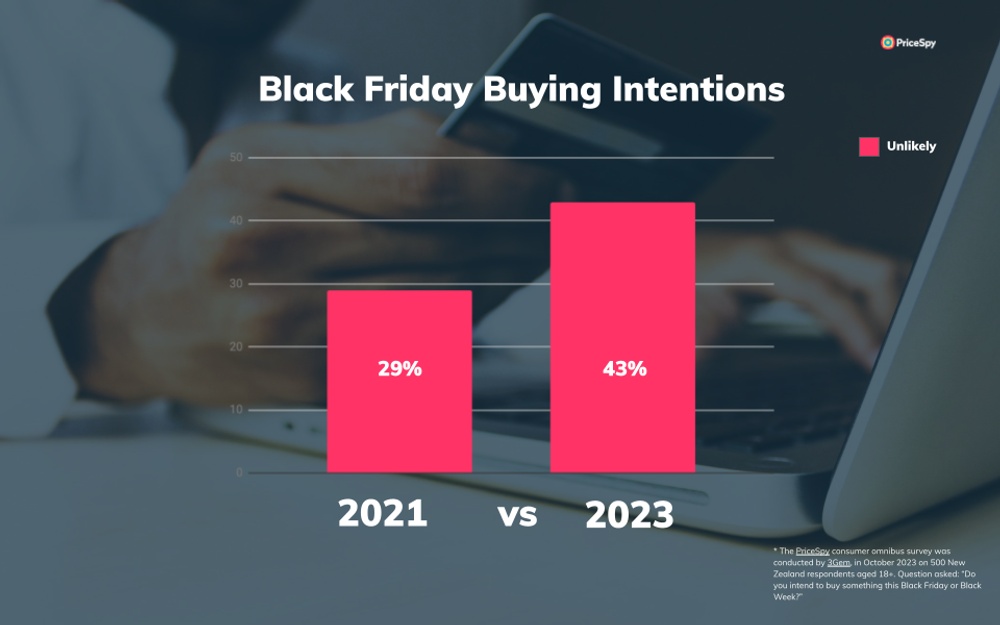

- Two-fifths (43 per cent) of respondents say they are unlikely to participate in Black Friday or Black Week, marking a 14 per cent increase compared to 2021’s findings.

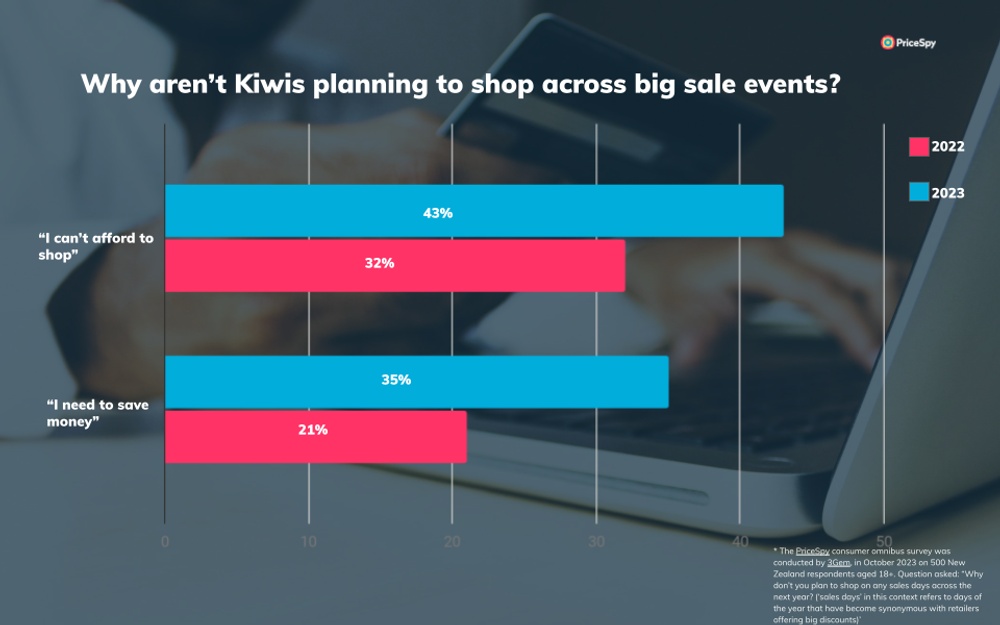

Amongst those that shared they aren’t planning to shop across any sales events over the next year:

- 43 per cent say “I can’t afford to shop’, delivering an 11 per cent increase from last year, and;

- 35 per cent say “I need to save money”, presenting a 14 per cent uptick on last year.

These findings reveal a noticeable sense of caution, reflecting growing consumer hesitancy in today's economy to spend, even during the bustling Black Friday season.

And how will shopping behaviours change?

Retailers, be prepared for shifting trends in Black Friday shopping

This year’s survey findings delivered some interesting shifts in trends around how consumers will shop this Black Friday.

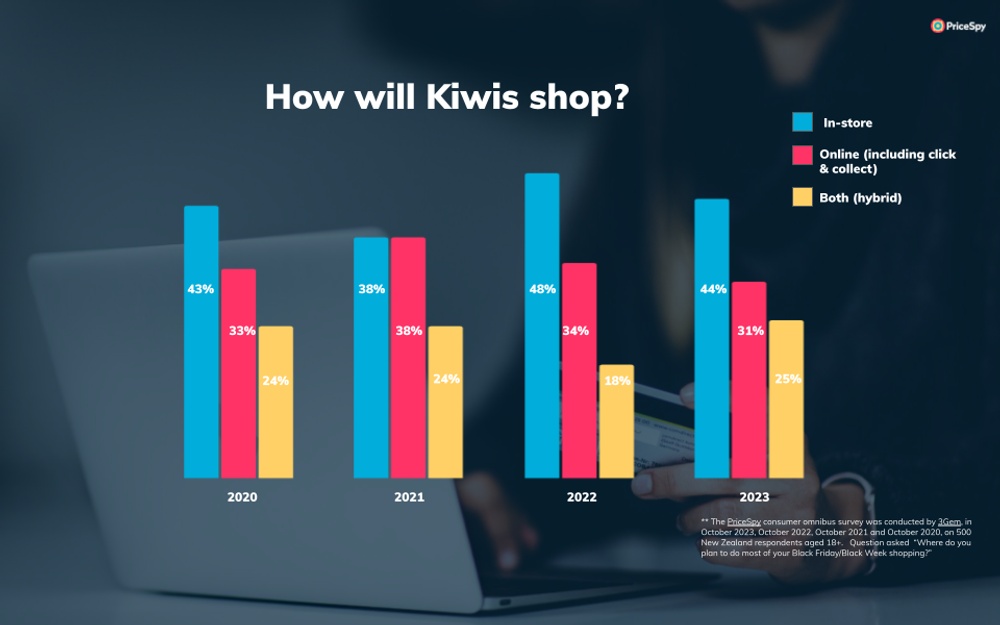

Hybrid Shopping on the Rise

The most significant change from 2022 to 2023 is the increase in consumers opting for a hybrid shopping experience, rising from 18 per cent to 25 per cent. This highlights a growing comfort in using both online and in-store channels for value and convenience.

Slight Decline in Physical Store Preference

Brick-and-mortar stores still attract a significant share of Black Friday shoppers, but there's a modest dip from 47 per cent in 2022 to 44 per cent this year. This could indicate consumers scouting online discounts first or embracing hybrid shopping.

Moderate Drop in Exclusive Online Shoppers

This year, those intending to shop exclusively online decreased from 34 per cent in 2022 to 31 per cent in 2023. It underscores the value of the in-store experience, especially for products requiring tactile interaction.

In summary, consumers are becoming more adaptable and tactical in their Black Friday shopping. The hybrid model blends in-store immediacy with online convenience. The evolving landscape suggests a complex and adaptable Black Friday shopper willing to use multiple channels to achieve their shopping goals. Retailers take note!

Will Black Friday give Kiwis the discounts they want (and need)?

This section of The Black Friday Report delves into New Zealanders' expectations for Black Friday and Black Week discounts.

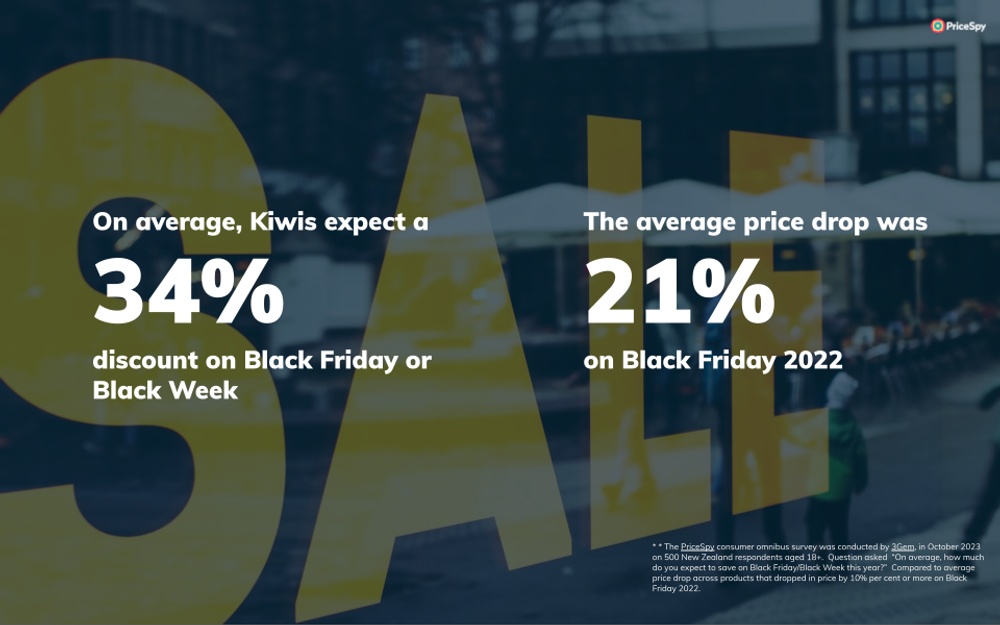

Discount expectations - Kiwis expect to save a third this Black Friday or Black Week!

Last year, PriceSpy’s survey revealed that Kiwis expected an average discount of 41 per cent on Black Friday and Black Week.

But this year, the results were more moderate:

- According to PriceSpy’s latest survey results, New Zealanders now anticipate an average discount of a third (34 per cent), signifying a seven per cent year-on-year decline.

These figures suggest that New Zealanders are adopting a more realistic outlook to the discounts available across Black Friday and Black Week.

Reality Check - Average savings likely to be closer to 21 per cent

While consumer discount expectations are becoming more grounded, they still appear to over-estimate what's likely to be offered on Black Friday:

- PriceSpy's pricing analysis of last year’s Black Friday event revealed that among the products that experienced a price drop of 10 per cent or more, the average discount was 21 per cent.

But, bigger discounts are still possible…

While consumer expectations exceed the average discount offered on Black Friday, it's important to emphasise that the 21 per cent represents an average.

By conducting thorough pricing research across big sale events like Black Friday and Black Week, shoppers significantly increase their chances of discovering discounts that surpass this average.

What's Worth Buying on Black Friday?

For instance, among the shopping categories that witnessed an average price drop of 10 per cent or more on Black Friday last year, PriceSpy's data indicates the following categories offer excellent discount opportunities:

- Xbox Games: 37% discount*

- PS4 Games: 43% discount*

- Airfryers: 29% discount*

- PS5 Games: 44% discount*

*Average discount on PriceSpy across the categories that dropped in price by 10 per cent or more on Black Friday 2022 compared to 1 November 2022.

And PriceSpy's ongoing research suggests that Black Friday discounts are progressively improving!

Based on PriceSpy’s Price Index data**, the indexed price drop on Black Friday has improved across the last four years:

While these percentage changes may not seem substantial, they are - this is because PriceSpy tracks thousands of indexed price changes multiple times a day. Ultimately, the data shows that Black Friday discounts are vastly improving!

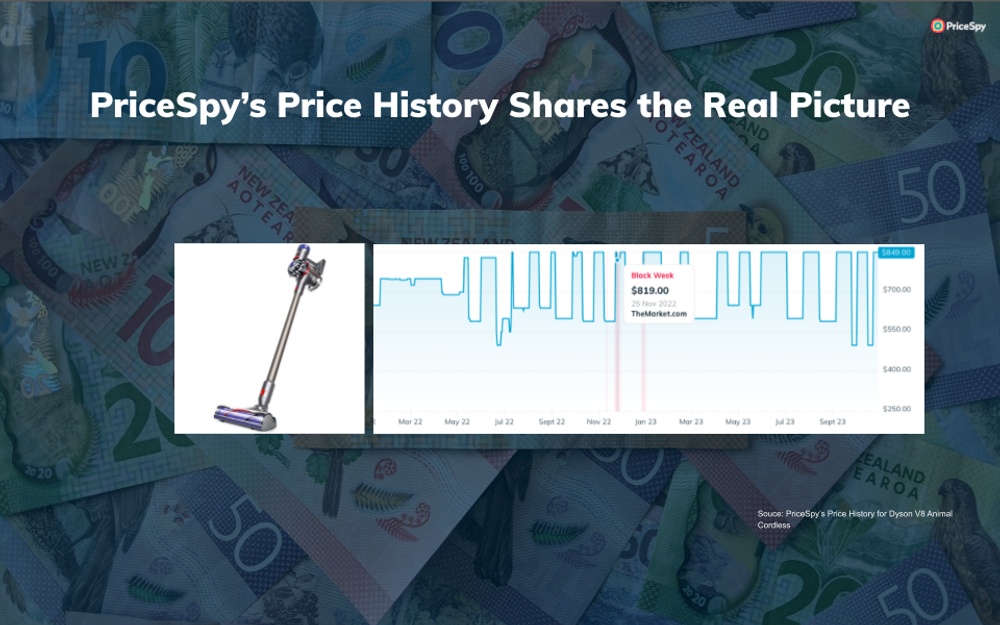

Remember - not everything is cheaper on Black Friday!

Contrary to belief, Black Friday doesn't always offer the cheapest deals. PriceSpy analysed price points across the top 20 products that consumers were looking to buy across 2022, comparing the lowest prices up to six months before and after Black Friday***.

Examples of popular products that are cheaper to buy before Black Friday (up to six months):

|

Most-popular products on PriceSpy between 1 January - 31 December 2022 |

Black Friday price (2022)* |

Can it be purchased for less six months before Black Friday 2022? |

Cheapest price before Black Friday 2022 (up to six months) |

Difference ($) |

Difference (%) |

|

$409.00 |

Yes |

$375.00 |

-34.00 |

-8.31% |

|

|

$729.00 |

Yes |

$649.00 |

-80.00 |

-10.97% |

|

|

$1,199.00 |

Yes |

$819.00 |

-380.00 |

-31.69% |

|

|

$458.00 |

Yes |

$406.00 |

-52.00 |

-11.35% |

|

|

$535.00 |

Yes |

$525.00 |

-10.00 |

-1.87% |

***Full research document is available on request

Key Findings

Pre-Black Friday

- Three-fifths (60 per cent) of the most-popular products researched were found to be priced lower than the lowest Black Friday price;

Post-Black Friday

- Over four-fifths (85 per cent) of the most-popular products researched could be purchased for less after Black Friday;

Black Friday

- Only 10 per cent of all the researched the most-popular products were at their lowest price on Black Friday;

- Whereas a staggering 90 per cent of the researched products could be purchased at a lower price either up to six months before or six months after the sale event.

PriceSpy's latest findings indicate that popular products often offer limited discounts during sale events, like Black Friday. This trend is likely driven by sustained high demand for these products, reducing the need for retailers to incentivise purchases through significant markdowns.

Conducting thorough pricing research is the key to determining the true value of a price drop on Black Friday!

Smart shopping tips for Black Friday

To wrap up this year’s Black Friday Report, see below PriceSpy’s top tips on how to shop like a professional this sales season:

1. Preparation is key

The best chance of finding a good bargain comes from preparation. If shoppers know in advance what they are interested in and have a rough idea of the price, they’re less likely to get carried away by the hustle and bustle of a sale. Set up a price alert on PriceSpy, to help keep you updated automatically if a price suddenly drops.

2. Check out the competition

Before you buy, take time to check if an offer is as good as it sounds by checking out the competition. Is the same TV set available at an even better price elsewhere?

Price points can vary massively depending on where you buy – by checking out prices from shop to shop, you can potentially save thousands!

3. See through the marketing bluff and do your own independent research

Even if a product you are looking to buy is being advertised with a high discount percentage, don't take the retailer's word for it. Always conduct your own independent research using an impartial price comparison site or app, like PriceSpy.

4. Check the price history

As well as looking for the best price from competitor shops, be sure to look at a product’s price history.

This vital piece of research is key in helping shoppers identify whether the sale item has been priced cheaper at other times of the year, or hiked before Black Friday.

And if the deal isn't as good as it should be, be prepared to walk away.

5. Keep a cool head and don’t panic buy

Whilst it’s very easy to get caught up in the hype surrounding Black Friday, shoppers need to be aware that fake sales and price hikes do exist! If you see a good deal, keep your cool, do your research – and don’t panic buy!

Keep up-to-date with all the Black Friday offers in one place on PriceSpy’s Black Friday deals page.

Key takeaways

- Black Friday is a significant event in New Zealand's retail landscape.

- But Kiwis are feeling the impact of the cost of living crisis, with rising prices affecting spending habits.

- Will this be the most expensive Black Friday yet?

- As the retail spending showdown approaches, how will shoppers respond?

- PriceSpy's survey indicates that many Kiwis still plan to shop on Black Friday, with spending intentions found to have risen compared to last year.

- However, a growing number do not intend to participate, which is likely caused by today’s economic challenges.

- Will Black Friday deliver?

- Kiwis have high expectations for Black Friday discounts

- Finding the best deals requires thorough price research

- Discounts on Black Friday are improving, but not everything is necessarily cheaper.

- Following PriceSpy's top tips for sale shopping is crucial to making the most of Black Friday deals.

The PriceSpy consumer omnibus survey

* The PriceSpy consumer omnibus survey in 2023 was conducted by 3Gem, in October 2022, on 500 New Zealand respondents.

* The PriceSpy consumer omnibus survey in 2022 was conducted by 3Gem, in October 2022, on 500 New Zealand respondents.

* The PriceSpy consumer omnibus survey in 2021 was conducted by 3Gem, in October 2021, on 500 New Zealand respondents.

* The PriceSpy consumer omnibus survey in 2020 was conducted by 3Gem, in October 2020, on 500 New Zealand respondents.

* The PriceSpy consumer omnibus survey in 2019 was conducted by Savanta, in October 2019, on 506 New Zealand respondents. * The PriceSpy consumer omnibus survey in 2018 was conducted by VIGA (now Savanta), on 30 October 2018, on 527 New Zealand respondents.

** PriceSpy’s Price Index is a daily updated chain index that tracks price changes across all categories, brands and markets over time. Products are weighted by popularity, determined by the number of clicks-out received and the number of stores offering the product. The index works much like a stock index, where daily price changes are used to calculate the accumulated index, and where company size corresponds to product popularity. Old products will gracefully disappear and new products enter the index. The index shows the relative price change of already existing products from the day before.

About PriceSpy NZ

PriceSpy is a comprehensive price and product comparison service used by millions of consumers every month. It helps consumers find, discover, research and compare products. Since the business first started in 2002, its main objective has been to help consumers make better purchasing decisions. PriceSpy does this by collecting and sharing honest, transparent information about retail stores, products and prices. PriceSpy has 108,000 indexed products, 1,730,000 indexed prices, 584,000 product ratings, 7,510 store ratings and 1183 stores. Providing a fully impartial comparison service for consumers and a deep depository of price data for retailers. PriceSpy is part of Schibsted and is located in Sweden, Norway, Denmark, Finland, New Zealand, France and the United Kingdom. The PriceSpy app is available to download for free, via the App Store and Google Play.

Contacts